Initiating Coverage | Capital goods

April 6, 2018

GMM Pfaudler Limited

BUY

CMP

`712

‘Lining’ up ‘glassy’ growth story

Target Price

`861

GMM Pfaudler Limited (GMM) is the Indian market leader in glass-lined (GL)

Investment Period

12 Months

steel equipment used in corrosive chemical processes of agrochemicals, specialty

chemical and pharma sector. The company is seeing strong order inflow from

the user industries which is likely to provide 20%+ growth outlook for next

Stock Info

couple of years.

Sector

Industrial Machinery

Market leader in niche space: Supported by patented technology of its global

Market Cap (` cr)

1,040

parent- Pfaulder Inc, GMM commands 50%+ market share in `400 cr Indian GL

Beta

0.7

space (~67% of the standalone business). The second player- Swiss Glascoat is

52 Week High / Low

884/504

just 1/5th of GMM’s business. GMM has a strong and sticky clientele comprising

Avg. Daily Volume

5,837

global giants in chemicals and pharma space.

Face Value (`)

2

Robust demand from user industries: In the last 7 years, GMM has seen a CAGR

BSE Sensex

33,597

of 9% in revenue. This is expected to cross 15%+ over the next few years mainly

Nifty

10,325

led by uptick in demand from user industries. Indian agrochemicals and specialty

Reuters Code

GMMP.BO

chemicals players are seeing a buoyant demand due to slowdown in Chinese

Bloomberg Code

GMM.IN

competition. Most of these companies are expanding or upgrading their

manufacturing facilities which will augur well for GMM.

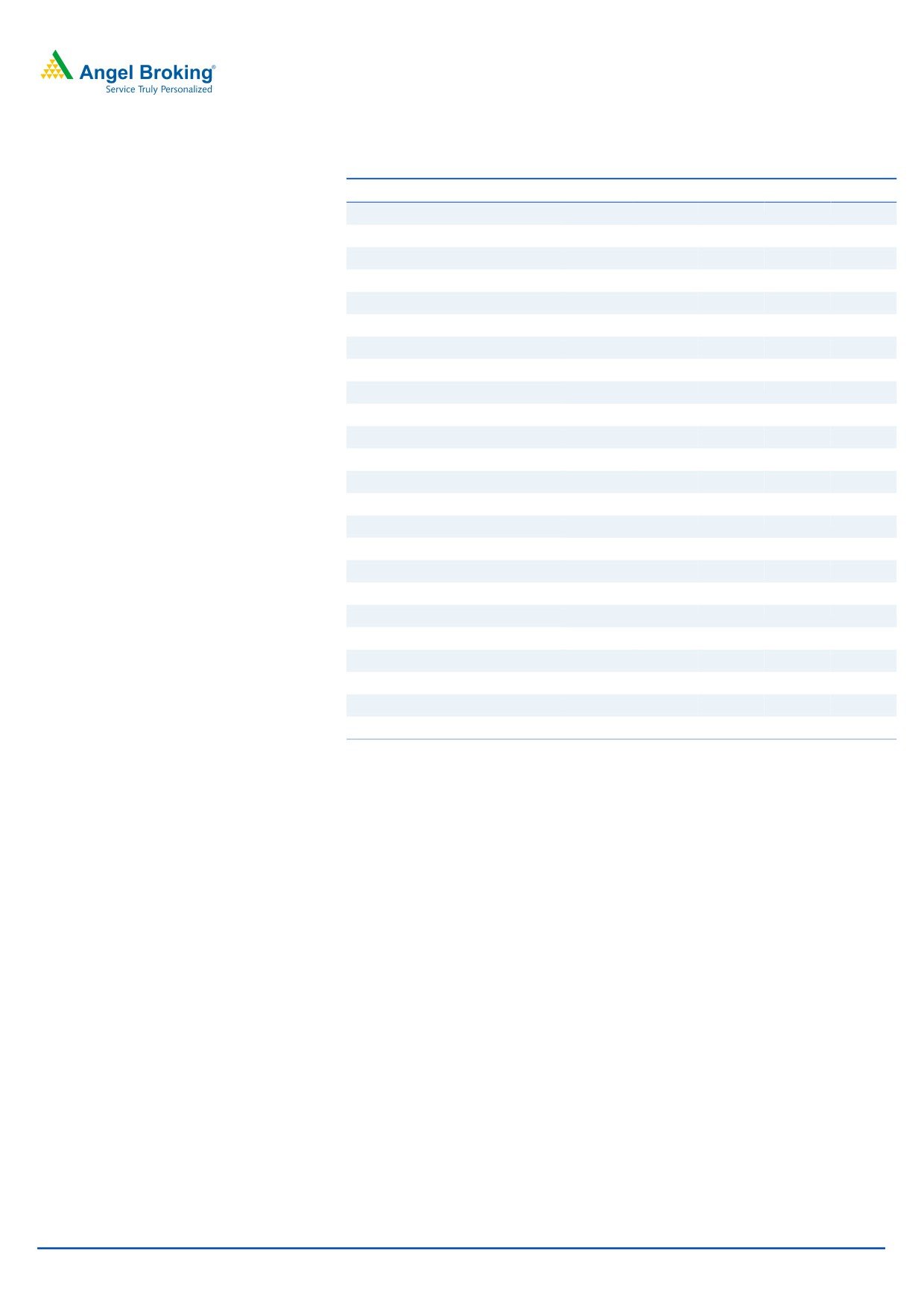

Shareholding Pattern (%)

Non-GL business and exports to boost growth: GMM has increased focus on the

Promoters

75.0

non-GL business, which includes mixing equipment, filtration and drying

MF / Banks / Indian Fls

0.4

equipment for the chemical processing industry. It is expecting to increase its

FII / NRIs / OCBs

0.1

share of non-GL business to 50% by 2020. Pfaudler Inc has been taken over by

Indian Public / Others

24.5

DB AG (a German PE firm) in 2014 which is keen on increasing exports from its

Indian entity to supply to Europe. GMM is targeting to increase exports to 15-

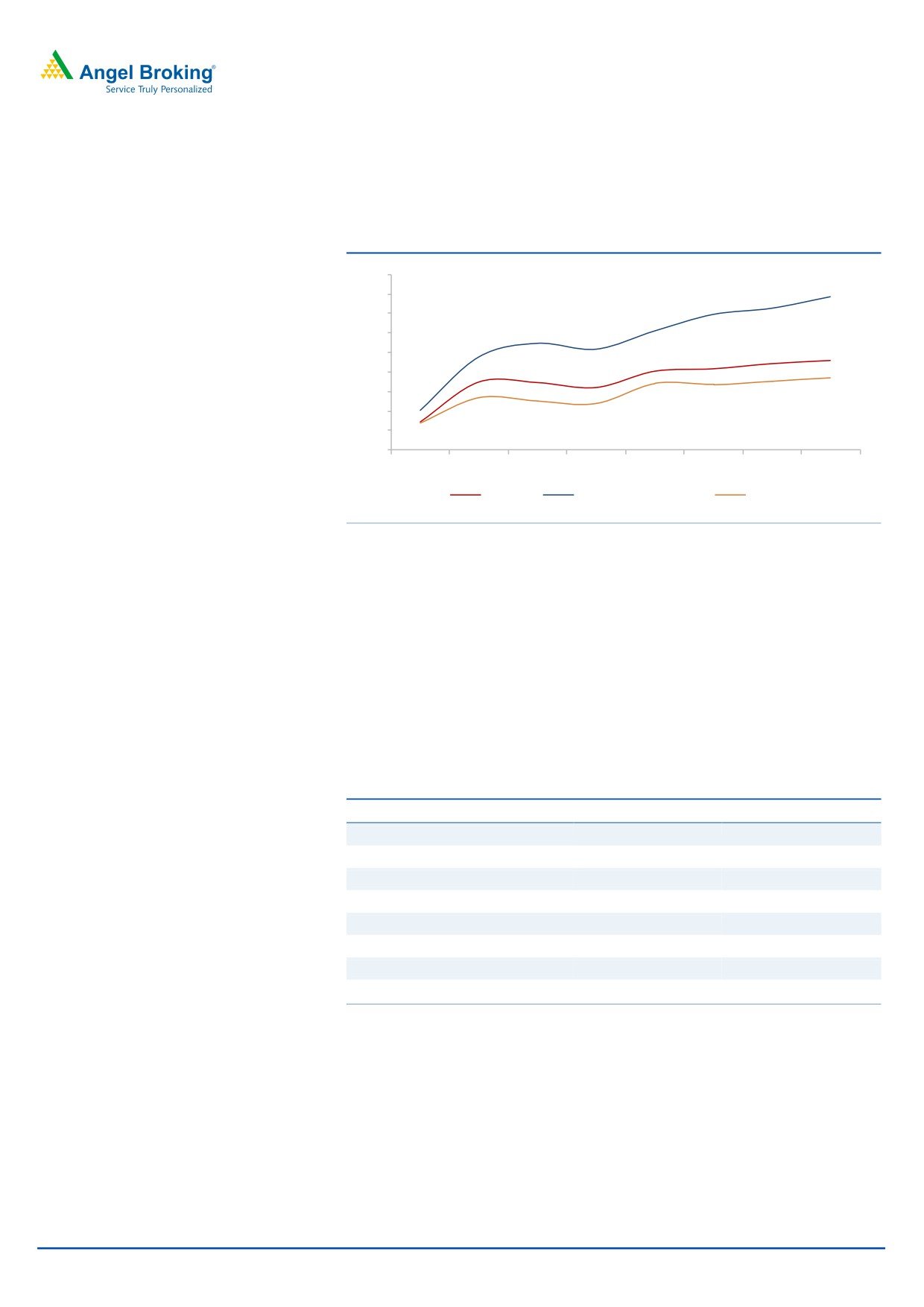

Abs.(%)

3m 1yr

3yr

20% of revenue from 6% in FY2017.

Sensex

(2.1)

10.9

16.7

GMM Pfaudler

(10.3)

35.2

132.9

Outlook & Valuation: GMM is likely to maintain the 20%+ growth trajectory over

FY18-20 backed by capacity expansion and cross selling of non-GL products to

its clients. The stock is currently trading at 16.5x FY2020 EPS, which offers good

3-year price chart

opportunity to enter the stock. We are initiating coverage on GMM with a Buy

recommendation and Target Price of `861 (20x FY2020E EPS), indicating an

upside of ~21% from the current levels.

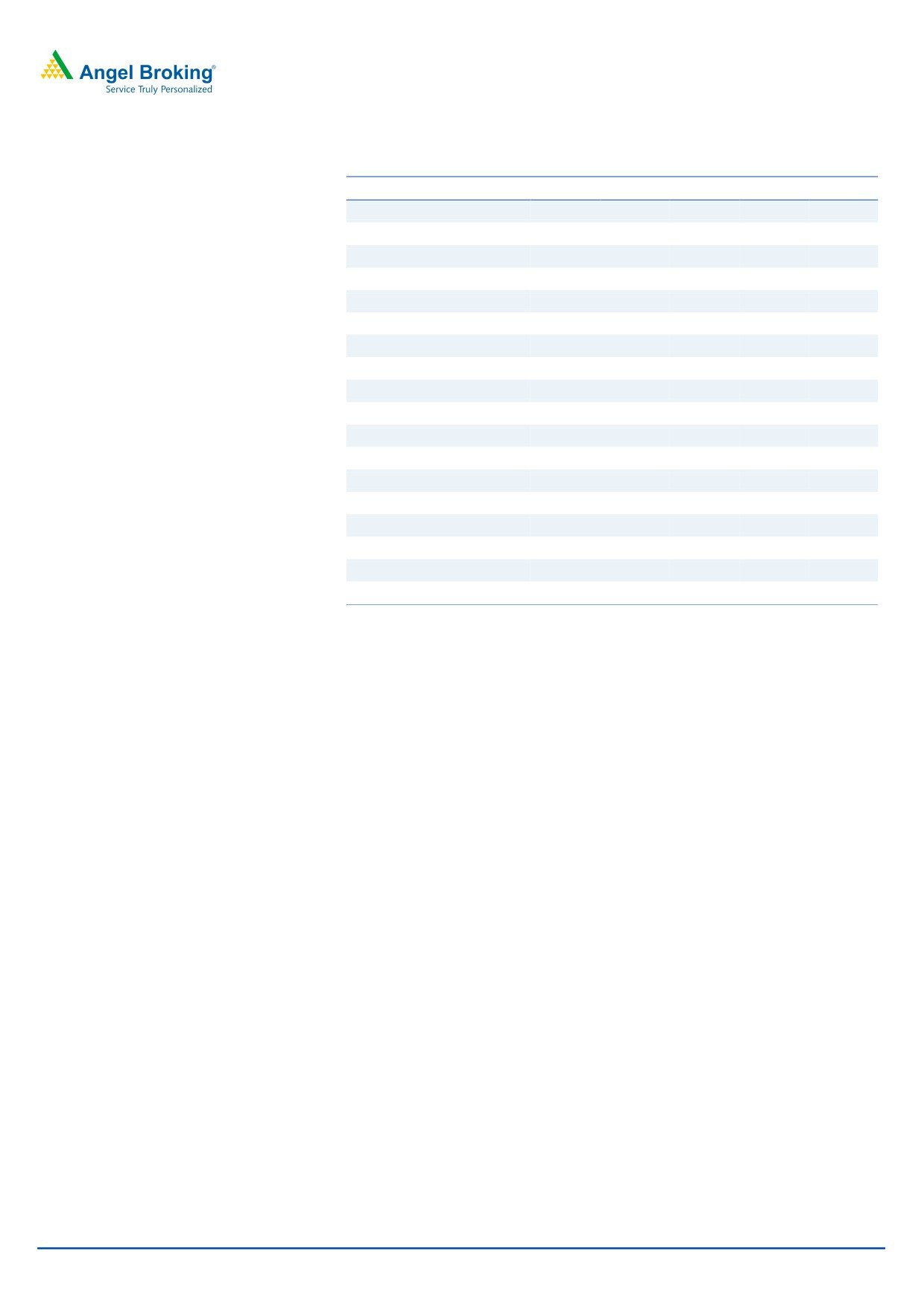

Key Financials (Consolidated)

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

Net Sales

292.1

353.0

434.8

532.7

649.8

% chg

-5.1

20.9

23.2

22.5

22.0

Net Profit

19.9

33.3

41.3

51.4

62.9

% chg

6.4

67.0

24.3

24.3

22.4

Source: Company, Angel Research

EBITDA (%)

12.0

13.5

13.9

14.1

14.1

EPS (`)

13.6

22.8

28.3

35.2

43.1

P/E (x)

52.2

31.3

25.1

20.2

16.5

Nidhi Agrawal

022-39357800 Ext: 6872

P/BV (x)

6.2

5.3

4.5

3.8

3.2

RoE (%)

11.9

17.1

18.0

18.8

19.3

RoCE (%)

16.1

20.3

22.4

23.5

24.1

EV/EBITDA(x)

27.8

20.2

15.7

12.5

10.0

EV/Sales(x)

3.3

2.7

2.2

1.8

1.4

Source: Company, Angel Research; Note: closing price as of April 05, 2018

Please refer to important disclosures at the end of this report

1

GMM Pfaudler | Initiating Coverage

Company Background

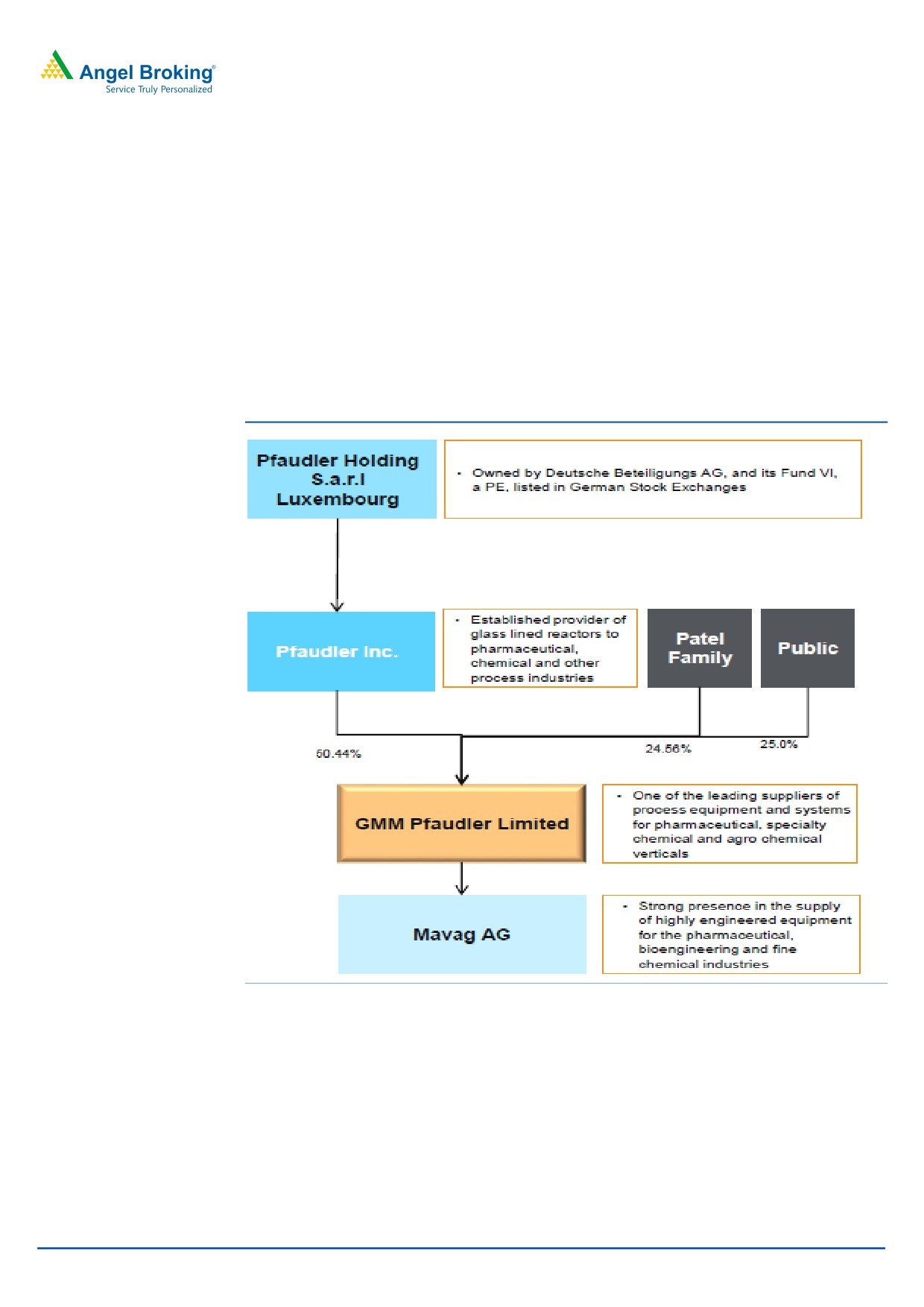

GMM was established in 1962 as Gujarat Machinery Manufacturers and is listed

on the Bombay Stock exchange. In 1987, Pfaudler Inc., USA, the world leader in

Glass Lined equipment subscribed to 40% equity to form a joint venture. Pfaudler

Inc. further increased their stake to 51% in 1999 and the name of the company

was changed to GMM Pfaudler Ltd. It has a state-of-the-art manufacturing facility

spread over 17 acres in Karamsad, Gujarat. Over the years, the company has

diversified its product portfolio to include Heavy Engineering, Mixing Systems,

Engineered Systems and Filtration & Drying Equipment to grow revenue and

reduce the cyclicality of the business.

Exhibit 1: Organization overview

Source: Company

Business Segments :

The Company has 3 business segments:

i) Glass Lined Equipment (GL): GMM is the market leader in this segment and

maintained its leadership position in the domestic market during the year. The

production increased from 1196 vessels to 1435 vessels in FY2017. The company

is further increasing production to 2000 vessels in FY2018. The Company

manufactured and supplied the first batch of vessels to Pfaudler, Italy which will be

sold in the European market.

April 06, 2018

2

GMM Pfaudler | Initiating Coverage

Exhibit 2: Glass Lined Equipments

Source: Company

ii) Heavy Engineering (HE): The HE business has been a focus area for the

company. GMM managed to grow the business by leveraging its brand, strong

engineering capabilities, multiple code accreditations and proven track record of

manufacturing complex equipment.

Exhibit 3: Pressure Vessels

Source: Company

iii) Proprietary Products (PP): This business line includes the following products:

Mixing Systems (MS), Engineered Systems (ES) and Filtration & Drying Equipment

(F&D).

a) Mixing Systems (MS):

Pharmaceutical, Agrochemical and Specialty Chemical Companies in India are

looking at innovative mixing solutions to improve productivity. To exploit these

opportunities, the Company has built engineering capabilities and cost effective &

user friendly equipment. It is also targeting new industry segments like Paints,

Resins, Inks, Biotech, Food Processing, Petrochemicals and Pulp & Paper to grow

this business.

April 06, 2018

3

GMM Pfaudler | Initiating Coverage

Exhibit 4: Mixing Systems

Source: Company

b) Engineered Systems (ES):

The company has extensive experience in designing and manufacturing complete

Modular Skids. As the company moves from being an equipment supplier to a

solution provider, it is developing process engineering capabilities so as to provide

process guarantees to its customers.

Exhibit 5: Wiped Film Evaporators and Temperature Control Units

Source: Company

c) Filtration & Drying Equipment (F&D):

The company targets critical applications, such as high potency and sterile

applications. This business line has seen significant growth over the last few years

and will continue to target critical applications in the domestic and export markets

to grow this business even further. F&D division also provides low cost components

to its subsidiary Mavag AG.

April 06, 2018

4

GMM Pfaudler | Initiating Coverage

Exhibit 6: Filters and Spherical Dryer

Source: Company

Exhibit 7: Segments at a glance

%

Segments

Description

User Industries

Peers

revenue

Swiss Glasscoat, De

Specialty Chemicals,

Dietrich, Sachin

Glass Lined

Glass-lined (GL) steel equipment used in corrosive chemical

67%

Agro Chemicals,

Industries, Standard

Equipment

processes

Pharma

Glass Lining

Technoloy

Refineries, Oil & Gas,

Mining & Minerals,

Anup Engineering,

Heavy

Customised process equipment like heat exchangers, pressure

16%

Fertilizers, Chemical

Patel Airtemps,HLE

Engineering

vessels

Processing and

Engineers etc

Pharmaceutical.

Chemicals, Pharma,

Proprietary

Ancillaries products to GL like Mixing Systems (MS), Engineered

Swiss Glasscoat, De

17%

Food, Paper,

Products

Systems (ES) and Filtration & Drying Equipment (F&D).

Dietrich etc

Paints,etc

Source: Company, Angel Research

Strong and Sticky Clientele base…

GMM has a strong and sticky clientele comprising global giants in agrochemical,

chemical and pharma space for its GL business. Over the years, the pharma

sector’s share has come down from 60% to 40% whereas agrochemical and

specialty chemical now forms over 50% of the business. GL forms 8-10% of capex

undertaken by pharma sector, hence any uptick in pharma capex with setting up of

Phrama city in Hyderabad would be positive for company. With 50% market share

and sticky clientele, while GL business is to grow by sombre10-12% CAGR for next

few years. This growth is similar to GL business growth rate of 10% over FY2014-

17.

April 06, 2018

5

GMM Pfaudler | Initiating Coverage

Exhibit 8: Strong and Stable Customer Base

Source: Company, Angel Research

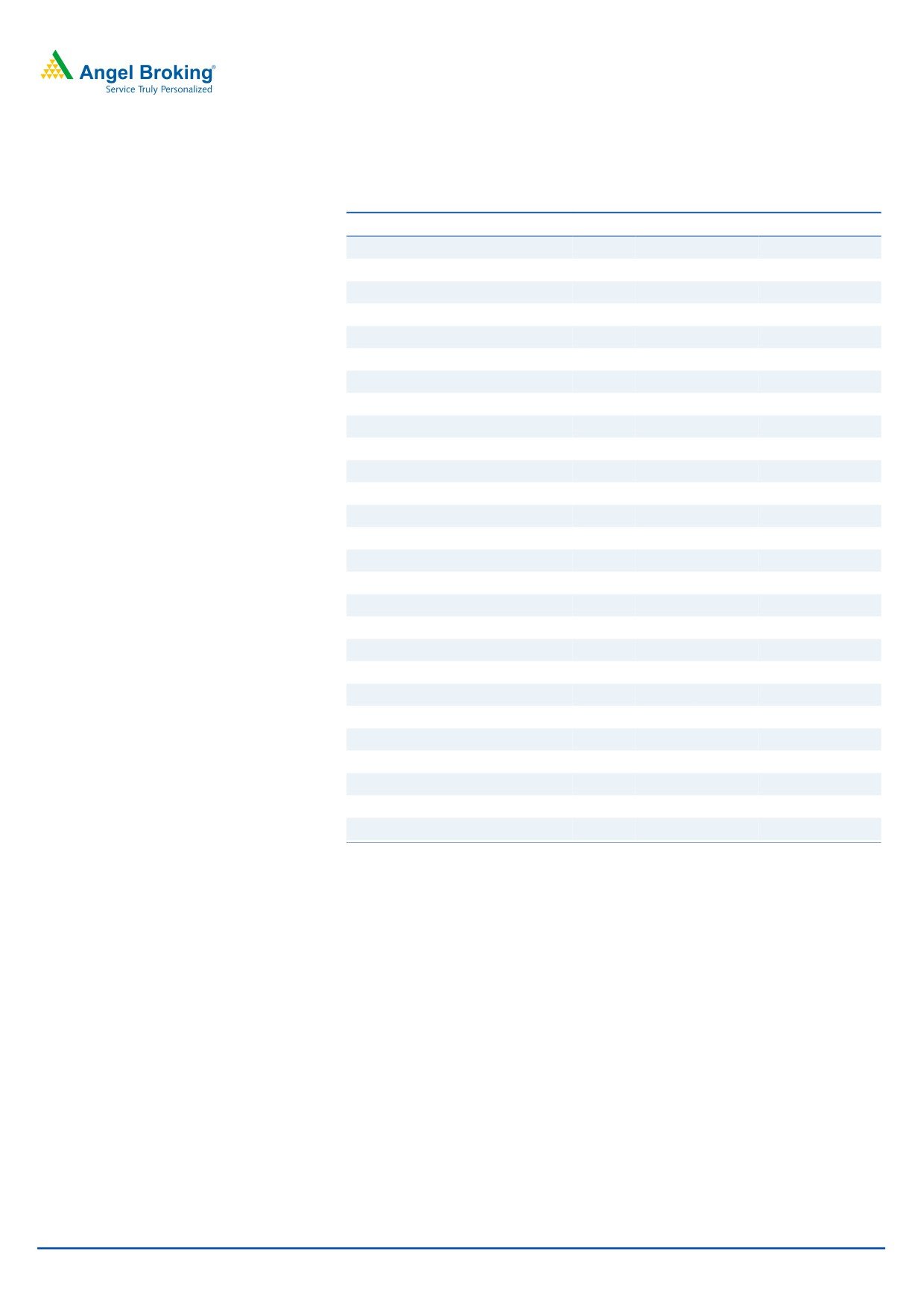

Non GL segments to drive growth

The company is using its track record and strong client relationship to cross sell its

ancillaries products to its clients. It is expecting to increase share of non-GL

business from the current 33% to 50% by 2020. The major growth is likely to come

from its non GL business which is likely to grow 35-40%. Global parent has been

taken over by DB AG (german PE firm) which is keen on increasing exports from

this Indian entity to supply especially to Europe. It is targeting to increase exports to

15-20% of revenue from 6% reported in FY2017.

Exhibit 9: Share of non-GL business to go up

FY20

FY19

FY18

FY17

0%

20%

40%

60%

80%

100%

120%

Glass lined equipment

Heavy engineering

Proprietry products

Source: Company, Angel Research

April 06, 2018

6

GMM Pfaudler | Initiating Coverage

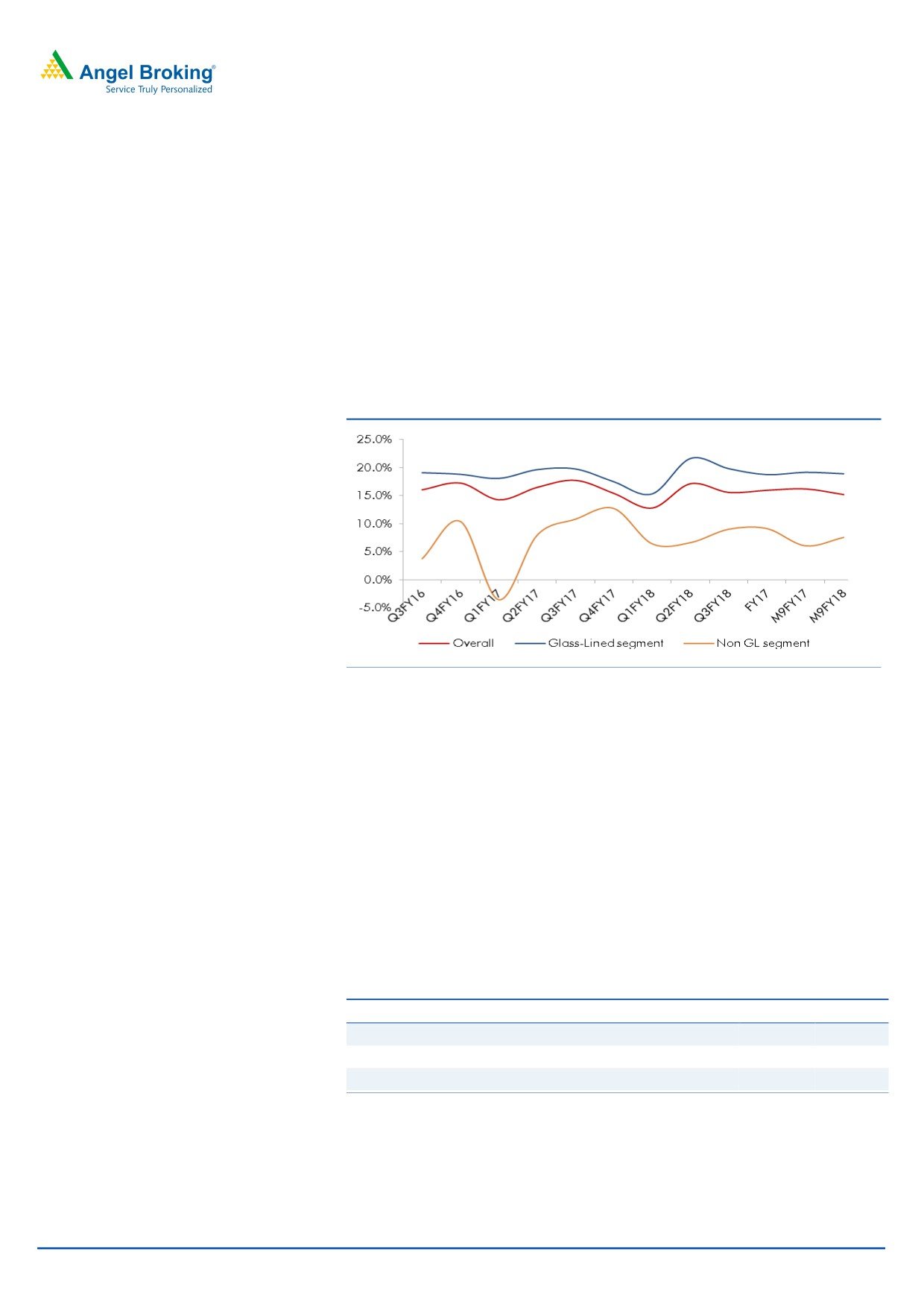

Margins to remain healthy

Margins in non-GL segments have seen a 150 bps improvement in M9FY2018 led

by operating leverage owing to 70% yoy growth in revenue. This is likely to

continue as agrochemical and specialty chemical industry continues to invest in

their manufacturing capacities which would boost GMM’s business in all

categories. Raw material forms 50% of the GL segment’s revenue and other

variable overheads forms 20%. It uses mainly carbon steel from players like SAIL

for which it maintains a quarterly inventory for steel and largely passes through RM

price variations for large contracts. Overall, margins are likely to sustain 13-14%

level.

Exhibit 10: Segment-wise margins

Source: Company, Angel Research

Its subsidiary - MAVAG is also expected to do well

In 2008, GMM acquired Mavag AG, Switzerland. Mavag supplies non GL/ highly

engineered equipment for critical filtration, drying and mixing applications to the

pharmaceutical and biotech industries. In the past, its profitability has been very

volatile due to high cost of production and slowdown in Europe. However, with

increased outsourcing from India and cost control measures being taken in this

company in the recent times, MAVAG is seeing uptick in margins as the business

traction improves. Operating leverage starts kicking in this business once its

business crosses 10 mn CHF (~`67 cr) in revenue which will drive margin

expansion in this entity in future.

Exhibit 11: MAVAG's Financial

` cr

FY15

FY16

FY17

Sales

84

70

88

PAT

2

1

6

PAT margin %

1.9%

1.4%

6.9%

Source: Company, Angel Research

Strong balance sheet and healthy return ratios

Its efficient working capital cycle of 40-45 days keeps on generating annual

operating cash flow in excess of `20 cr, which largely funds its annual

maintenance capex requirements of Rs 15 cr. GMM has recently expanded its

April 06, 2018

7

GMM Pfaudler | Initiating Coverage

capacity from

1400 unit to

2000 units through debottlenecking and

installation of a new gas furnace with a capex of `7 cr. This new furnace is

likely to save power cost for company. It is also looking at outsourcing some of

non core activities. The company is debt free and enjoys healthy return ratios.

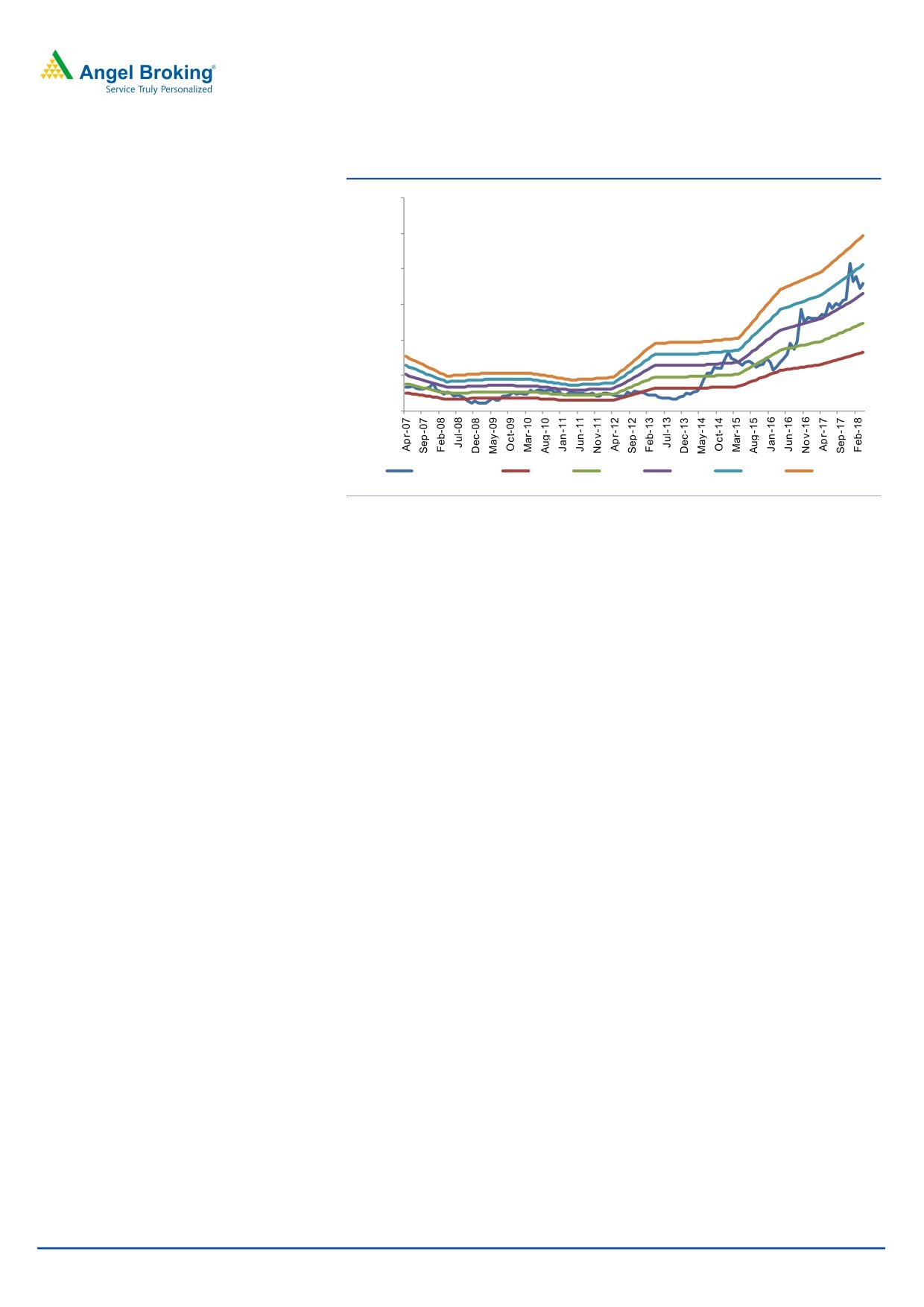

Exhibit 12: Return ratios are improving

45

40

35

30

25

20

15

10

5

-

FY13

FY14

FY15

FY16

FY17

FY18E FY19E FY20E

ROCE

Angel ROIC (Pre-tax)

ROE

Source: Company, Angel Research

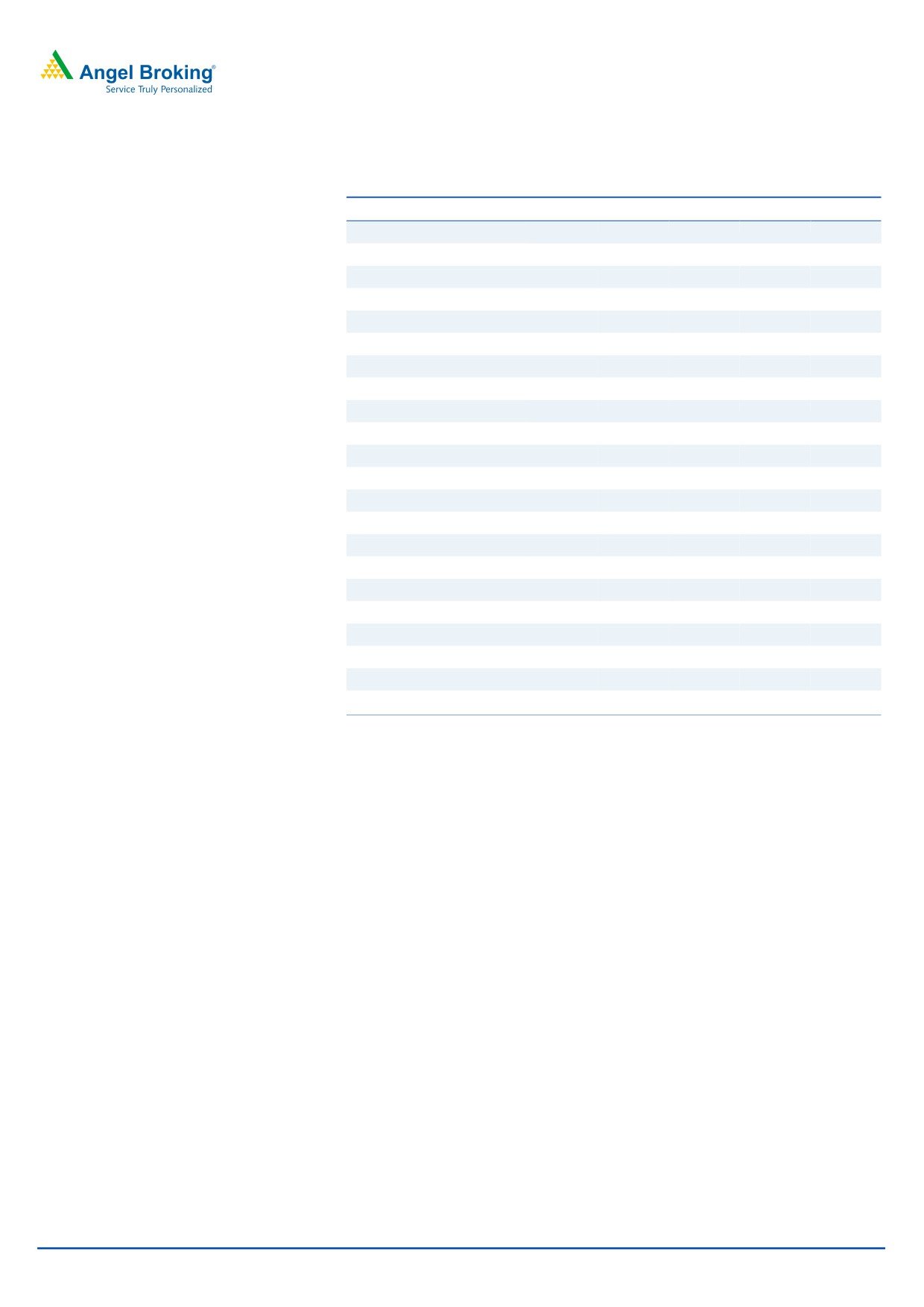

Outlook & Valuation

GMM is likely to maintain the 20%+ growth trajectory over FY18-20 backed by

capacity expansion and demand from user industries. Its nearest competitor- Swiss

Glascoat has been losing market share over the last few years while GMM has

been growing well over the same period. The stock is currently trading at 16.5x

FY2020 EPS, which offers good opportunity to enter the stock. We initiate coverage

on GMM with a ‘Buy’ recommendation and target price of `861 (20x FY2020E

EPS), indicating an upside of ~21% from the current levels.

Exhibit 13: Peer Comparison

Company Name (` cr)

GMM Pfaudler

Swiss Glascoat

FY2017

Sales

353.0

81.5

PAT

33.3

3.1

YoY growth %

67.0

-26.0

CAGR Growth % (FY2014-17)

Revenue

8.0

2.0

EBITDA

13.5

-2.0

PAT

17.0

-7.0

Source: capital line

April 06, 2018

8

GMM Pfaudler | Initiating Coverage

Exhibit 14: One Year Forward P/E

1200.00

1000.00

800.00

600.00

400.00

200.00

0.00

Close -Unit Curr

10.0 X

15.0 X

20.0 X

25.0 X

30.0 X

Source: Company, Angel Research

Risks to our estimates

GMM’s primary raw material is steel; any abrupt fluctuation in pricing will

adversely impact its profitability.

Business may get impacted owing to the inability to get break through with

new clients or slowdown in capex by its clients.

GMM has market exposure to foreign exchange rates mainly on account of

exports, imports and investments in foreign subsidiary, and therefore, it is

subjected to the exchange fluctuation risk.

April 06, 2018

9

GMM Pfaudler | Initiating Coverage

Profit & Loss Statement (consolidated)

Y/E March (` cr)

FY2016

FY2017 FY2018E FY2019E FY2020E

Total operating income

292.1

353.0

434.8

532.7

649.8

% chg

-5.1

20.9

23.2

22.5

22.0

Total Expenditure

257.1

305.3

374.2

457.7

558.3

COGS

173.4

209.6

258.1

316.3

385.8

Selling and Administration Expenses

19.2

22.1

25.4

31.1

37.9

Personnel

56.2

66.1

81.4

99.7

121.6

Others Expenses

8.4

7.6

9.3

10.7

13.0

EBITDA

34.9

47.7

60.6

75.0

91.4

% chg

-2.8

36.6

26.9

23.7

22.0

(% of Net Sales)

12.0

13.5

13.9

14.1

14.1

Depreciation& Amortisation

8.1

8.2

9.2

10.8

12.7

EBIT

26.8

39.5

51.4

64.2

78.7

% chg

2.7

47.3

30.1

24.9

22.7

(% of Net Sales)

9.2

11.2

11.8

12.0

12.1

Interest & other Charges

0.7

0.9

0.5

0.5

0.5

Other Income

3.6

8.3

9.9

11.9

14.3

(% of Sales)

1.2

2.3

2.3

2.2

2.2

Extraordinary Items

-

-

-

-

-

Share in profit of Associates

-

-

-

-

-

Recurring PBT

29.8

46.9

60.8

75.5

92.5

% chg

5.6

57.4

29.8

24.3

22.4

Tax

9.7

13.6

19.5

24.2

29.6

PAT (reported)

19.9

33.3

41.3

51.4

62.9

% chg

6.4

67.0

24.3

24.3

22.4

(% of Net Sales)

6.8

9.4

9.5

9.6

9.7

Basic & Fully Diluted EPS (Rs)

13.6

22.8

28.3

35.2

43.1

% chg

6.4

67.0

24.3

24.3

22.4

Source: Company, Angel Research

April 06, 2018

10

GMM Pfaudler | Initiating Coverage

Balance Sheet (consolidated)

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

Sources of funds

Equity Share Capital

2.9

2.9

2.9

2.9

2.9

Reserves& Surplus

163.9

191.9

226.8

270.1

323.2

Shareholders’ Funds

166.8

194.8

229.7

273.0

326.1

Minority Interest

-

-

-

-

-

Total Loans

-

-

-

-

-

Other Liab & Prov

4.4

11.1

11.6

12.1

12.8

Total Liabilities

171.3

205.9

241.3

285.2

338.9

Application Of Funds

Net Block

53.4

61.2

67.0

71.2

73.5

Capital Work-in-Progress

4.3

2.0

2.0

2.0

2.0

Investments

13.7

44.6

64.6

84.6

94.6

Current Assets

178.6

207.9

240.3

282.5

358.1

Inventories

70.9

82.3

101.3

124.1

151.4

Sundry Debtors

48.7

69.9

86.1

105.5

128.7

Cash

53.6

31.7

23.2

16.6

33.6

Loans & Advances

5.5

24.1

29.7

36.4

44.4

Other Assets

-

-

-

-

-

Current liabilities

84.4

113.2

137.0

160.5

195.8

Net Current Assets

94.2

94.7

103.3

122.0

162.2

Other Non Current Asset

5.6

3.4

4.3

5.3

6.5

Total Assets

171.3

205.9

241.3

285.2

338.9

Source: Company, Angel Research

April 06, 2018

11

GMM Pfaudler | Initiating Coverage

Cash Flow Statement (consolidated)

Y/E March (`cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

Profit before tax

29.8

46.9

60.8

75.5

92.5

Depreciation

8.1

8.2

9.2

10.8

12.7

Change in Working Capital

(2.0)

(12.8)

(15.0)

(25.4)

(23.2)

Interest / Dividend (Net)

-

-

-

-

-

Direct taxes paid

(9.6)

(14.0)

(19.5)

(24.2)

(29.6)

Others

1.8

5.3

-

-

-

Cash Flow from Operations

24.7

23.0

35.5

36.8

52.4

(Inc.)/ Dec. in Fixed Assets

(13.9)

(14.4)

(15.0)

(15.0)

(15.0)

(Inc.)/ Dec. in Investments

0.3

0.1

-

-

-

Cash Flow from Investing

(17.0)

(22.0)

(36.9)

(35.4)

(25.5)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

-

-

-

-

-

Others

6.0

6.3

6.5

8.0

9.8

Cash Flow from Financing

(6.0)

(6.3)

(6.5)

(8.0)

(9.8)

Inc./(Dec.) in Cash

1.7

(5.3)

(7.9)

(6.7)

17.1

Opening Cash balances

34.7

36.4

31.1

23.2

16.6

Closing Cash balances

36.4

31.1

23.2

16.6

33.6

Free cash Flow

10.8

8.6

20.5

21.8

37.4

Source: Company, Angel Research

April 06, 2018

12

GMM Pfaudler | Initiating Coverage

Key Ratios (consolidated)

Y/E March

FY2016

FY2017

FY2018E

FY2019E

FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

52.2

31.3

25.1

20.2

16.5

P/CEPS

27.9

18.3

14.9

12.1

9.9

P/BV

6.2

5.3

4.5

3.8

3.2

Dividend yield (%)

0.4

0.6

0.6

0.6

0.8

EV/Sales

3.3

2.7

2.2

1.8

1.4

EV/EBITDA

27.8

20.2

15.7

12.5

10.0

EV / Total Assets

5.7

4.7

3.9

3.3

2.7

Per Share Data (Rs)

EPS (Basic)

13.6

22.8

28.3

35.2

43.1

EPS (fully diluted)

13.6

22.8

28.3

35.2

43.1

Cash EPS

25.5

38.9

47.6

58.8

71.6

DPS

3.0

4.0

4.0

4.6

5.6

Book Value

114.3

133.4

157.3

187.0

223.3

Returns (%)

ROCE

16.1

20.3

22.4

23.5

24.1

Angel ROIC (Pre-tax)

25.8

30.5

33.5

34.9

37.4

ROE

11.9

17.1

18.0

18.8

19.3

Turnover ratios (x)

Asset Turnover (Gross Block)

2.6

3.1

3.5

3.8

4.2

Inventory / Sales (days)

89

85

85

85

85

Receivables (days)

61

72

72

72

72

Payables (days)

101

115

115

110

110

WC cycle (ex-cash) (days)

48

42

42

47

47

Source: Company, Angel Research

Note - Valuation done on closing price of 05/04/2018

April 06, 2018

13

GMM Pfaudler | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

GMM Pfaudler Ltd.

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

April 06, 2018

14